Patients receiving care at hospitals owned by private-equity firms experience more bloodstream and surgical site infections and they fall more often, a new study by academics at Harvard University and the University of Chicago has found.

The research, published Tuesday in the Journal of the American Medical Association, comes after previous studies that have asserted patients of private-equity-owned health care entities pay higher costs, experience reduced staffing levels and, in the case of nursing homes, have higher death rates.

The new study is by Dr. Sneha Kannan and Dr. Zirui Song, both of Harvard, and Joseph Dov Bruch of the University of Chicago. It focused on patients’ health outcomes in private-equity-owned hospitals, an area, the academics said, where research has been scant. Private-equity firms have bought out more than 200 hospitals from non-private-equity owners, the study noted. In addition, as NBC News has previously reported, an estimated 40% of hospital emergency departments across the country are managed by private–equity-backed staffing companies.

Early literature on private equity in hospitals “focused largely on changes in economic outcomes and staffing and some measures of process quality,” Song told NBC News in an interview. “We are aiming to examine changes in more meaningful measures of clinical quality at these hospitals after acquisition.”

Private-equity firms are sophisticated financiers that buy companies, usually load them with significant amounts of debt to pay for the acquisitions and hope to sell them in a few years at a profit. Over the past decade, eyeing hefty profit potential, these financiers have invested $1 trillion in health care companies.

Because the debt adds a cost burden to the acquired companies, their owners often cut other expenses by firing workers; the companies also try to generate higher revenues by increasing costs to customers. Some hospitals owned by private-equity firms sell the land under their buildings; these deals enrich their owners, who receive cash generated from the sales, but saddle the facilities with higher rent costs.

Song and his colleagues compared Medicare claims for patients at 51 acute-care hospitals owned by private-equity firms with data at 259 matched acute-care hospitals — hospitals of similar size and location — not owned by such firms. To see how the hospitals’ performance changed under private-equity ownership, the academics studied a period that began three years before a hospital was acquired by private equity and extended through three years after.

The acquisitions of the 51 hospitals took place between 2010 and 2017. The study identified neither the hospitals whose outcomes it recorded nor the private-equity firms that owned them.

After hospitals were purchased by private-equity firms, patients at these facilities experienced an average 25.4% increase in hospital-acquired conditions, such as infections or falls, compared with those treated at other hospitals in the same time frame, the study found. On average, patients at private-equity-owned facilities experienced a 27% increase in falls and double the surgical site infections, despite an 8% decline in surgical volume at the facilities.

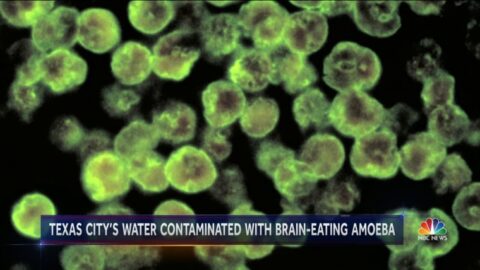

Patients at the private-equity-owned hospitals in the study also experienced a 38% average increase in central line infections, where germs enter the bloodstream from a tube placed in a large vein in the neck, chest or groin. The increase in central line infections at private-equity-owned hospitals occurred, the researchers said, even though those facilities had placed 16% fewer central lines in patients.

Conditions acquired in a hospital, such as infections or falls, are an established measure of inpatient quality, the researchers said, and are “considered preventable based on guidelines from the U.S. Centers for Medicare & Medicaid Services.” Medicare reimbursements paid to hospitals drop when the facilities report high numbers of hospital-acquired infections.

The study comes amid increased scrutiny on private-equity firms’ ownership of health care entities. Earlier this month, two senators announced a bipartisan investigation into the impact private-equity firms are having on the nation’s health care system.

That inquiry, launched by Sens. Chuck Grassley, an Iowa Republican, and Sheldon Whitehouse, a Rhode Island Democrat, centers on Lifepoint Health, a hospital chain owned by Apollo Global Management, and Prospect Medical Holdings, an operator of hospitals owned until recently by Leonard Green & Partners, a private-equity firm in Los Angeles. The senators requested information from the companies to assess how much profit they have generated through their complex financial arrangements and whether the deals harmed patients and clinicians.

In September, the Federal Trade Commission sued U.S. Anesthesia Partners Inc., one of the country’s top anesthesia staffing companies, and the private-equity firm backing it — Welsh, Carson, Anderson & Stowe. The FTC accused both entities of scheming over the course of a decade to acquire anesthesia practices in Texas, monopolize the market, drive up prices for patients and generate profits. Both companies deny the allegations and are fighting the suit.

Previous studies have identified adverse impacts when private equity owns a health care operation. A 2021 study by the American Antitrust Institute and the Petris Center at the University of California, Berkeley School of Public Health, concluded, “The private equity business model is fundamentally incompatible with sound healthcare that serves patients.”

The findings in the research published in JAMA on Tuesday “heighten concerns about the implications of private equity on health care delivery,” the authors concluded.

Song told NBC News he and his colleagues are continuing to study private equity’s impact on health care. The research released Tuesday, he said, reflects “the actual clinical quality of care on the ground.” He added, “This type of result might shift the narrative around the impact of private equity on quality of care and patient outcomes.”

Recent Comments